Financial modelling

for

BESS & Renewable Energy

Modelium is a renewable energy financial modelling platform for Solar, Wind & BESS.

Designed for investment teams to collaborate, move fast and model with confidence.

Built for speed and scale

Modelium is the fastest way to go from assumptions to investment-ready outputs in Solar, Wind & BESS project modelling.

All your Projects.

One Workspace.

Replace the chaos of Excel chains and outdated files with a clean, structured environment. Built for renewable energy.

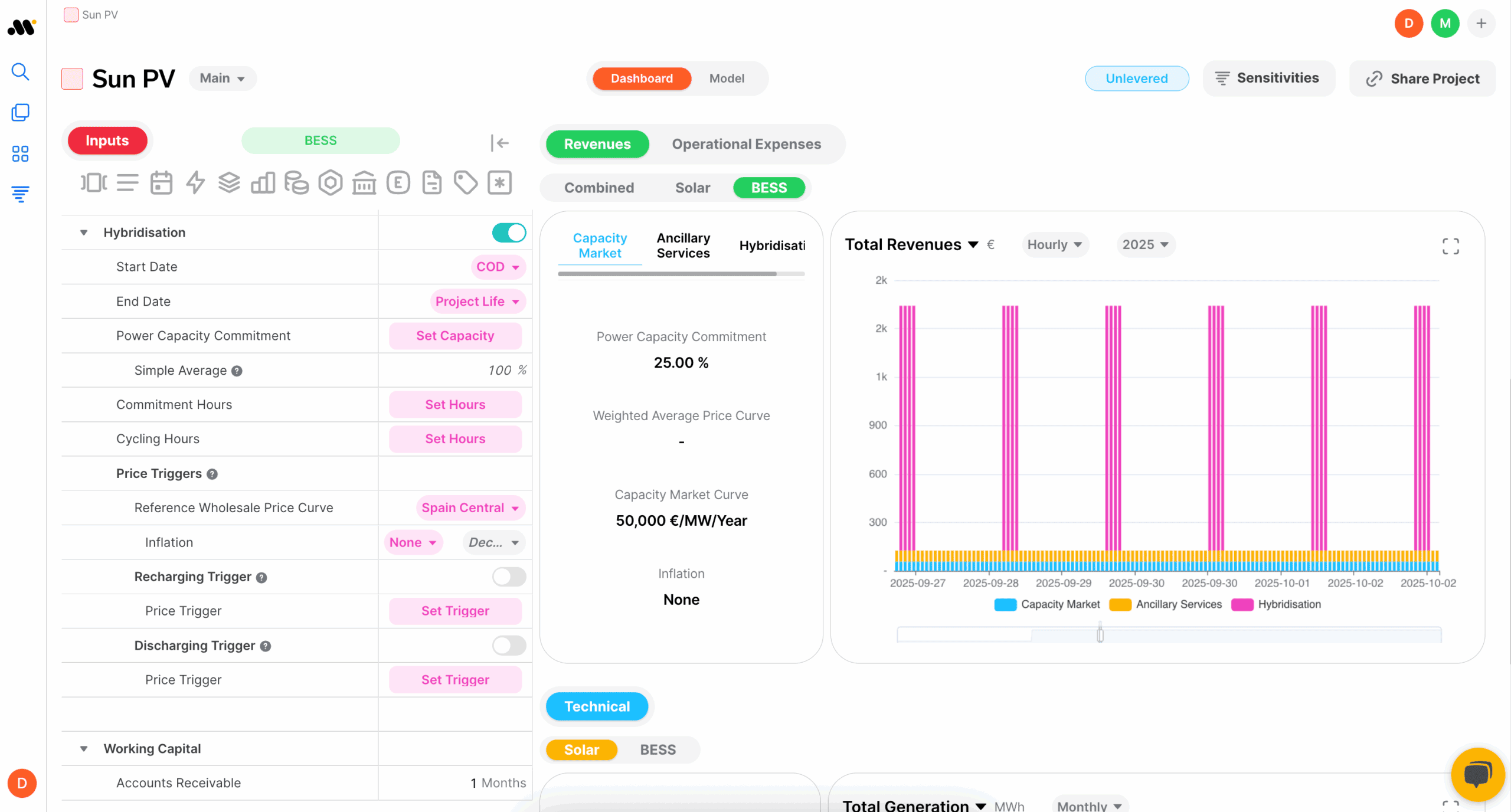

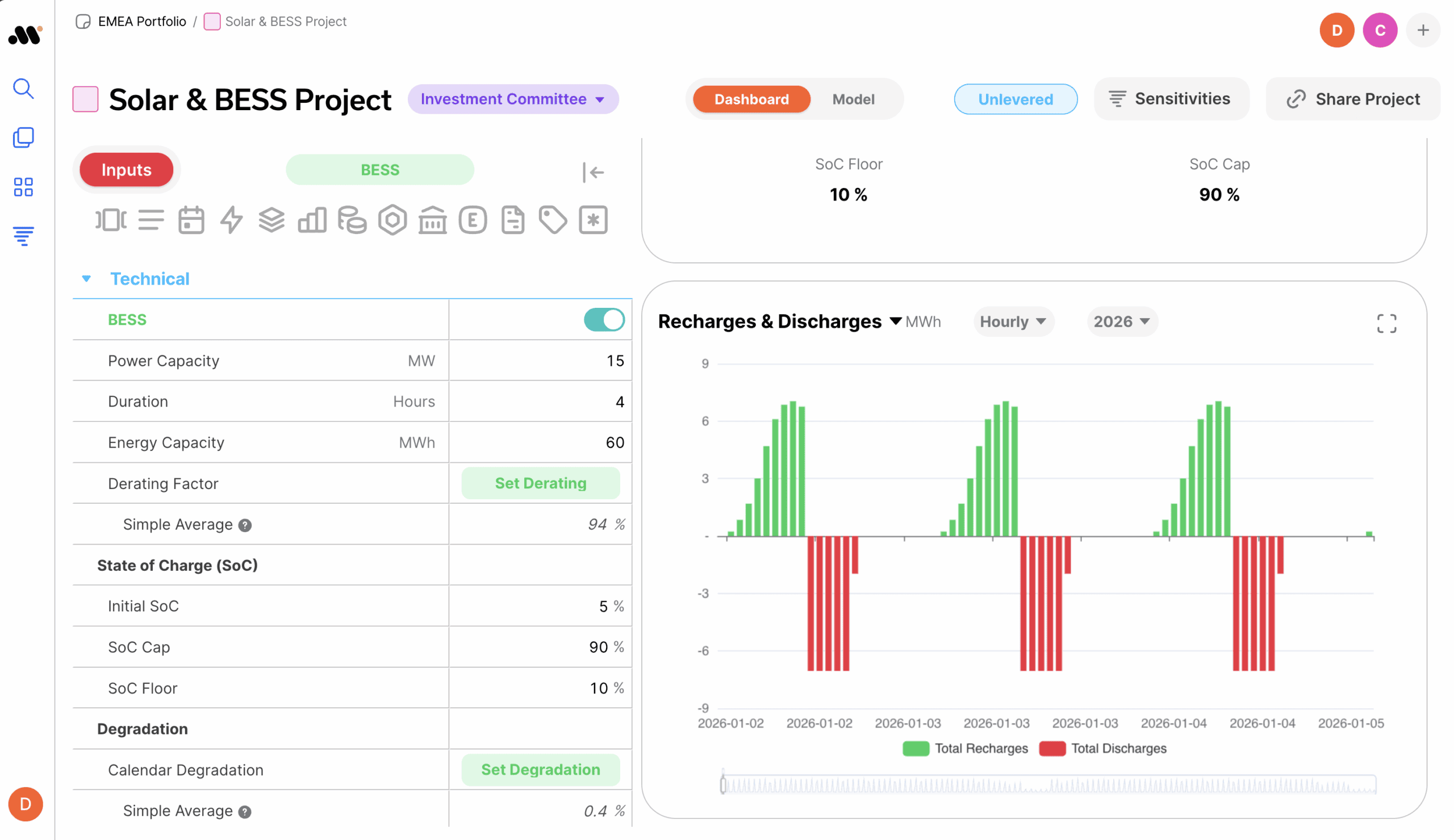

BESS financial modelling.

Done right.

Hourly resolution. Project-wide scope.

Hourly Modelling

Lifetime hourly dispatch modelling, including hybrid integrations with solar and wind.

Revenue Stacking

Energy arbitrage, capacity markets, ancillary services, and hybrid systems.

Hourly Cycling

Control hourly cycling to maximise revenues, manage degradation and preserve State of Health.

Endless Combinations

Model BESS with different durations and SoC limits to maximise your asset value.

Sophisticated project finance logic.

Built in.

Solar, Wind and BESS

One tool for every configuration. Combine multiple technologies, from standalone assets to fully integrated systems. Modelium is built for real project complexity.

Multi-market Ready

Define jurisdiction-specific tax logic. From standard corporate tax to thin capitalisation rules, tax loss carryforwards, and different depreciation schedules.

Bankable Debt Structures

From DSCR-based sizings to cash sweeps, grace periods, interest hedging strategies and more.

Real-time KPIs

IRR, NPV, cash yield, payback period, exit scenarios and more. All KPIs update instantly as your team refines assumptions. No need to refresh, recalculate, or request updated outputs.

Everyone in your workspace is

connected.

Model Faster

Stop wasting hours on formatting and error-checking. Automate and focus on real analysis.

Full Control

Change inputs, run scenarios, and understand every number. No more black box models.

No More Bottlenecks

Collaborate in real time without waiting for approvals or version updates. Everyone works on the same model now.

Accelerate Valuations

Stop rebuilding the same model for every deal. Run full valuations in minutes.

Market-Specific Intelligence

Don’t guess local rules. Model taxes, tariffs and merchant risk accurately for each country.

Built for Project Finance

Model DSCR-based sizings, cash sweeps, grace periods and reference rate hedging. Plus everything else you’d expect in a full debt model.

Portfolio Visibility

Get a clear picture of pipeline in real time. Returns, risks and everything you need in one dashboard.

Reduce Time-to-Decision

Standardised logic across teams makes approvals faster and safer.

Built for Growth

Designed to scale across geographies, technologies and growing teams.

Trust the Numbers

Transparent and standardised methodology aligned with investment committee requirements.

Scenario-Ready

Quickly compare downside, base and upside cases. No post-approval surprises.

Focus on the Decision

No messy spreadsheets or unclear logic. Just clean outputs, ready for a go or no-go.

From Idea to Investment Case

From teaser to full valuation in minutes. Quickly structure, stress-test and present project economics.

Real-Time Iterations

Adjust technical parameters, capex items or project timelines and get updated economics instantly.

Stop Relying on Others

Validate opportunities yourself without waiting for finance or tech teams.

- Analysts

Model Faster

Stop wasting hours on formatting and error-checking. Automate and focus on real analysis.

Full Control

Change inputs, run scenarios, and understand every number. No more black box models.

No More Bottlenecks

Collaborate in real time without waiting for approvals or version updates. Everyone works on the same model now.

- M&A Managers

Accelerate Valuations

Stop rebuilding the same model for every deal. Run full valuations in minutes.

Market-Specific Intelligence

Don’t guess local rules. Model taxes, tariffs and merchant risk accurately for each country.

Built for Project Finance

Model DSCR-based sizings, cash sweeps, grace periods and reference rate hedging. Plus everything else you’d expect in a full debt model.

- Executives

Portfolio Visibility

Get a clear picture of pipeline in real time. Returns, risks and everything you need in one dashboard.

Reduce Time-to-Decision

Standardised logic across teams makes approvals faster and safer.

Built for Growth

Designed to scale across geographies, technologies and growing teams.

- BD Managers

From Idea to Investment Case

From teaser to full valuation in minutes. Quickly structure, stress-test and present project economics.

Real-Time Iterations

Adjust technical parameters, capex items or project timelines and get updated economics instantly.

Stop Relying on Others

Validate opportunities yourself without waiting for finance or tech teams.

- IC Decision-Makers

Trust the Numbers

Transparent and standardised methodology aligned with investment committee requirements.

Scenario-Ready

Quickly compare downside, base and upside cases. No post-approval surprises.

Focus on the Decision

No messy spreadsheets or unclear logic. Just clean outputs, ready for a go or no-go.